The Ultra-Low Emission Bus Scheme is the latest round of funding to support the purchase of new buses from the Office for Zero Emission Vehicles (OZEV) and the Department for Transport (DfT).

The £48m scheme is available to local authorities and bus operators in England and Wales (Scotland and Northern Ireland have their own incentive programmes) to help purchase Ultra-Low Emission Buses (ULEBs) and supporting infrastructure from 2018 - 2021.

The primary drivers of the ULEB Scheme are the reduction of greenhouse gas emissions from buses along with the reduction of other emissions, such as harmful NOx and Particulate Matter.

The ULEB Scheme builds on lessons learned from the Green Bus Fund(£90m, which ran from 2009-2015) and the Low Emission Bus Scheme(£41m, 2015-2017) which have delivered over 1,600 buses in service and £10m worth of supporting infrastructure.

Like Low Carbon Emission Buses and Low Emission Buses, ULEBs will be eligible for the 6 pence per kilometre BSOG LCEB incentive. This incentive is set for review in the coming years and Zemo Partnership will be supporting DfT to move towards an emissions savings related incentive i.e. greater emissions savings rewards a higher rate of incentive for operation.

What is an Ultra-Low Emission Bus?

An Ultra-Low Emission Bus saves 30% well-to-wheel greenhouse gas emissions over the UK Bus Cycle compared to a Euro VI diesel bus of equivalent passenger capacity and has a Euro VI certified engine or equivalent emissions capability.

An Ultra-Low Emission Bus is defined against the average greenhouse gas emission performance of an equivalent Euro VI diesel bus. In autumn 2017, Zemo Partnership conducted a test programme on 8 Euro VI diesel buses on behalf of DfT and OLEV to understand the average performance of the latest conventional diesel buses.

ULEB

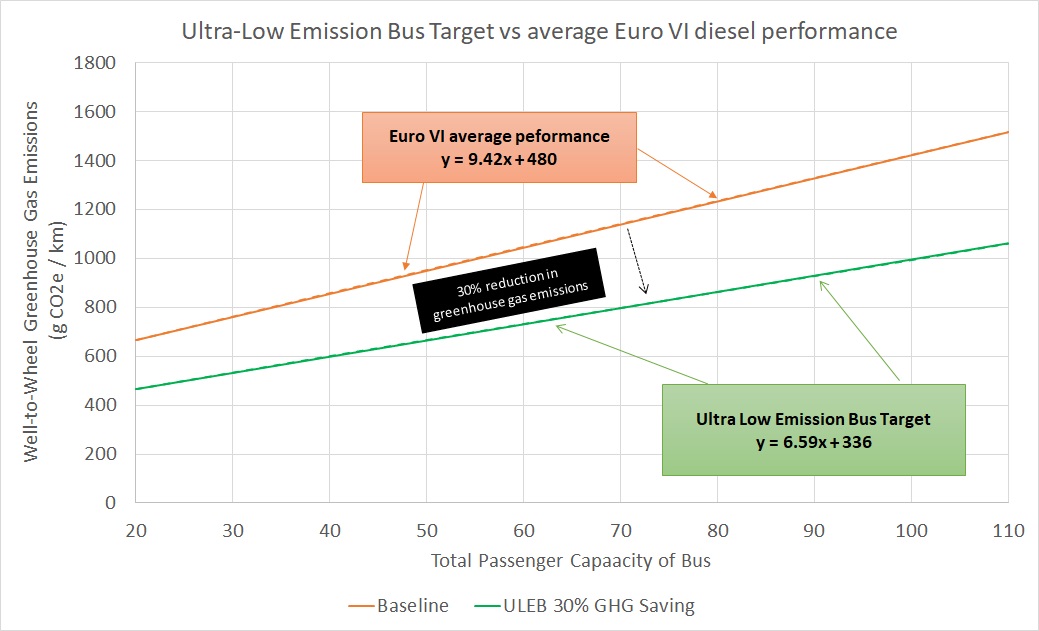

Based on this test data, we can take the greenhouse gas emissions emissions plotted against total passenger capacity of the bus to create a formula that enables us to estimate the greenhouse gas performance of any Euro VI diesel bus.

Based on the performance of Low Emission Buses, Zemo Partnership has set the target for an Ultra-Low Emission Bus at 30% greenhouse gas saving on a well-to-wheel basis.This target is designed to encourage innovation from bus manufacturers and to ensure that government money is spent on supporting the most efficient and lowest emission buses available.

The 30% greenhouse gas emissions target is described as:

[Well-to-Wheel Greenhouse Gas Emissions] = 6.59 x [Total Passenger Capacity] + 336

The graph below describes the average performance of a Euro VI diesel bus based on its passenger capacity and what a low carbon bus needs to achieve to become a ULEB.

To give an example, a manufacturer has a bus of 70 total passengers and wants to know what greenhouse gas target in g CO2e /km the bus must achieve to qualify as a ULEB. Using the formula, the manufacturer can calculate the target greenhouse gas emissions in g CO2e/km the vehicle must achieve:

Greenhouse gas emissions target (g CO2e/km) = 6.59 x [70] + 336

Greenhouse gas emissions target to achieve ULEB accreditation = 797.3 g CO2e / km

With knowledge of the performance of products performance from previous schemes, a manufacturer will be able to predict if the bus is likely to achieve ULEB accreditation. To achieve this, the manufacturer must test the bus of the UK Bus Cycle and then submit the results to Zemo Partnership and DfT to gain certification. Once approved, the certificate of achievement is published on the Zemo Partnership website under ULEB Certificates page.

Test procedure: UK Bus Cycle (UKBC)

To qualify as an ULEB, manufacturers must test their vehicle over the UK Bus Cycle test procedure. This procedure builds on the work of previous schemes for the Low Carbon Emission Bus and Low Emission Bus accreditation procedures.

Key test changes from LEB to ULEB

- Test chamber temperature set at 10⁰C (previously 18⁰C)

- Rural phase is moved to the rear of the test from the front (due to high speeds giving unrealistic NOx performance in other two phases)

- Average emissions results must be taken from three consecutive tests.

- Ancillary loads are switched on, including:

- Internal and external lights, headlamps set to dim

- Internal saloon heating turned on, set to 17⁰C

- Doors are opened at each designated bus stop during test

- Power steering is activated during bus stop.

- Diesel heater emissions to be added to overall emissions performance.

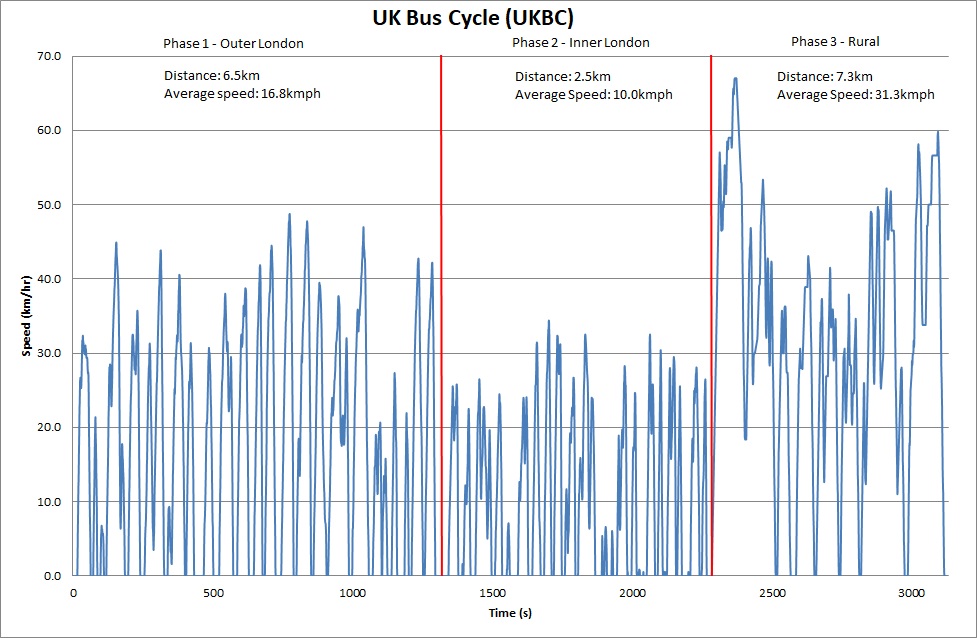

The UKBC contains three test phases that simulate different areas of bus operation: Inner, Outer and Rural as shown in the speed vs time graph below. Prior to the test itself, the vehicle performs a single outer phase as a warm up to enable to engine output to stabilise.

The inner and outer London phases were taken from real world behaviour of a bus. Route 159, which runs from Streatham to Oxford Circus, was used to create the MLTB test cycle. The rural phase was taken from the VECTO simulation tool that has been developed by the European Commission to calculate emissions from HGVs.

Find out more about the UK Bus Cycle test procedure, download the ULEB test procedure guidance documents below.

ULEB Test Procedure Guidance

More detailed test procedures are being transferred and updated from previous LCEB testing and will be published in September 2018. The previous LCEB test procedural notes are available here:

Test procedure for conventional powertrains

Test procedure for charge sustaining hybrid powertrains

Test procedure for charge depleting hybrid powertrains

BSOG LCEB incentive

The Bus Service Operator Grant (BSOG) Low Carbon Emission Bus (LCEB) incentive is designed to ensure that operators running more fuel-efficient vehicles would be entitled to similar financial support as operators running conventional diesel vehicles.

Operators that run public routes are entitled to claim money from the DfT based on the amount of fuel used over miles operated. Fuel efficient, lower carbon buses use less fuel and therefore operators are entitled to claim less financial support, therefore the BSOG LCEB incentive was created to balance the reduction in payback and incentivise operators to operate LCEBs.

If a vehicle qualifies as an LCEB, LEB or ULEB and runs on a publicly accessible route, it is entitled to receive £0.06/km operated. View more information on BSOG.

Grant funding structure

Zemo Partnership has supported DfT to design a grant structure which rewards both greenhouse gas emissions savings and zero emission capability. Once qualified as a ULEB, an operator or local authority is entitled to apply for grant funding to support the purchase of the bus, up to 75% the total incremental cost difference.

ULEBs tend to be lower volume production and contain more expensive components and as such the grant support offered by OLEV and DfT is to help fund the cost difference between buying a conventional bus and a ULEB.

Incremental cost difference = cost of new ULEB – cost of new Euro VI diesel (with the same total passenger capacity).

Example:

- New single deck Euro VI diesel costs £190,000

- New single deck ULEB costs £350,000

- Incremental cost difference = £350,000-£190,000 = £160,000

£150 per gram of CO2e /km saved vs Euro VI diesel; grant reward up to 50% of incremental cost difference. e.g. 300g CO2e/km saved = £45,000 grant. (50% incremental cost = £160,000/2= £80,000)

£500 per zero emission kilometre, up to 100km, grant reward up to 25% incremental cost difference. e.g. 120km zero emission range = 120*£500= £60,000 grant. However, 25% of incremental cost of £160,000 = £40,000. Therefore, max grant award is £40,000.

The ULEB in this example is entitled to £45,000 for greenhouse gas savings and £40,000 from its zero emission range, totalling £85,000 grant (53% incremental cost).

The previous LEB scheme enabled operators and local authorities to claim up to 90% of the incremental cost difference between the LEB and a Euro VI diesel. Zemo Partnership has recommended a reduction in the grant support to enable bidders to negotiate more competitive bids from manufacturers.

Infrastructure

Applicants to the ULEB Scheme are entitled to claim up to 75% of the cost of installing infrastructure that can support either ULEBs or LEBs.

Applicants can apply for infrastructure only grants, with no request for vehicle support. For example, under the LEB scheme, Nottingham City Council was awarded almost £1m to support the installation of electric charging infrastructure.

As the conditions of achieving ULEB accreditation are more challenging than the previous LEB accreditation scheme, OLEV and DfT will offer grant support for infrastructure that supports either LEBs or ULEBs (or both), provided the emissions saving benefits are illustrated in the application.

As such, providing the vehicles that will use the infrastructure have a Low Emission Bus certificate, an infrastructure only bid will be eligible for funding.

Diesel heaters

To date, all the electric buses in the UK have been fitted with diesel heaters as heating draws a significant amount of energy from the battery. This energy draw for heating has a significant impact on the available range of the vehicle, which in some cases results in vehicles not being able to achieve a full day’s operation.

Zemo Partnership is working closely with manufacturers and technology providers to establish the impact of diesel heaters in relation to air quality, and is strongly encouraging all parties to adopt zero emissions heating.